Payroll software is a digital payroll solution for managing and automating the employee payment process. Common features include calculating employee wages, subtracting withholdings and deductions, and generating the direct deposit file. When you use a payroll solution, the process is automated for ease of use without taking away your ability to edit wages or deductions to accommodate special circumstances.

Increase Efficiency & Peace of Mind for You and Employees

Eliminate the manual entry, errors, and headaches that come from ineffective payroll technology, and drive a better employee experience. Empower your workforce to manage their finances proactively by offering self-service capabilities such as visibility into upcoming paychecks and early access to earned wages. Give employees the opportunity to flag any timecard issues before you run payroll to take some of the workload off your shoulders. Automate expense reimbursements by adding them directly to paychecks. Minimize manual tasks, save time, and have peace of mind knowing your employees are getting paid correctly and on time.

More Than Your Standard Payroll Solution

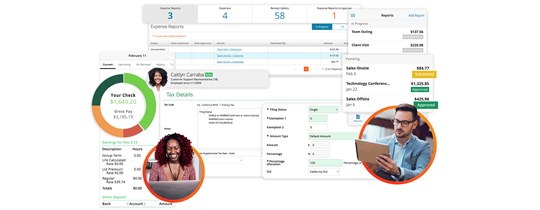

Easy Expense Management

Minimize manual data entry and automatically add reimbursements to paychecks. Eliminate paper shuffling with a tool built directly into your payroll software.

Dedicated Tax Support

Lessen your burden of liability with assistance from our experts. Paylocity is a Registered Reporting Agent with the IRS in all 50 states, Puerto Rico, Virgin Islands, and Guam.

A Competitive Employee Benefit

Assist with recruiting and retention by offering early access to earned wages. Reduce employees’ financial stress with zero impact on your payroll process and cash flow.

Hassle-Free Garnishment Management

Wage garnishments are common, complicated, and can result in severe consequences if mishandled. Paylocity’s dedicated team of experts can handle every step of the garnishment process on your behalf to prevent costly mistakes.

Seamless International Support

Take the stress out of managing international employees and foreign currencies with a seamlessly integrated solution. Paylocity provides integrated global payroll with real-time access to aggregated payroll data across 100+ countries.

Payroll Features Overview

Customize Your Payroll

Work with our experts to configure check types, general ledgers, time off accruals, and reporting to reduce admin effort and allow for quick, actionable decision-making.

Reduce Manual Data Entry

Hours, dollars, and labor allocations flow directly into Payroll from Time & Labor.

Automate Processes

Default configurations and overrides automate manual steps and ensure completeness of payroll data. Automatic calculation of prorated and retro pay saves time and effort.

Ensure Paycheck Accuracy

Trust that your payroll is accurate by previewing the register prior to processing. Let our automatic payroll audits act as safeguards and call out any unexpected data entry.

Easily Connect to Other Business Systems

Automatically transfer information on 401(k), retirement plans, and benefit files with preferred vendor(s) via easy integration, or unlock custom integrations with open APIs.

Ease Tax Compliance, Regardless of Location

Tax geolocation can audit each employee to ensure they’re set up to pay the correct taxes based on their location.

Take Back Your Time with Modern Payroll Solutions

Small Business Payroll

Spend more time growing your business and less time stressing over payroll. Explore Paylocity’s solutions to streamline and automate your payroll, specifically tailored to small business needs.

Payroll Processing Basics

Learn the ins and outs of payroll processing, including key functions, timelines, employer responsibilities, plus learn how an automated payroll system can save your business time and money.

Essential Payroll Features

Not all payroll software is built the same. Explore nine must-have features to ensure that your current or future full-service payroll provider is serving your organization’s needs.

Frequently Asked Questions

The benefits of an online payroll solution include:

- Reduced time spent on payroll processing, leaving you with more time for strategic initiatives.

- Improved compliance with state and federal laws and streamlined tax filing processes.

- Decreased likelihood of costly payroll errors.

- Easier access to essential documents for employees through self-service portals, including pay stubs and W-2s.

Cloud-based payroll software is hosted online and accessed through the internet, rather than software installed on your business premises or through an outsourced solution. This allows HR professionals and employees to securely access payroll information and functionality from any location, at any time, even if they aren’t in the office.

Switching payroll providers doesn’t have to be complicated.

- The first phase involves requesting a demo and proposals from your candidate payroll vendors.

- Once you’ve chosen a new provider, you’ll need to review your current payroll contract and request pertinent documents (like payroll records, employee information, and other tax related forms).

- Before you officially make the switch, coordinate tax filings, and let internal stakeholders know about the change – then you can officially transition and go live with your new payroll solution.

For more detailed information, review our guide to switching payroll companies to learn more about how to make your transition as seamless as possible.